Help section for AL VAT Control

HOW TO DO THE SETUP FOR AL VAT CONTROL

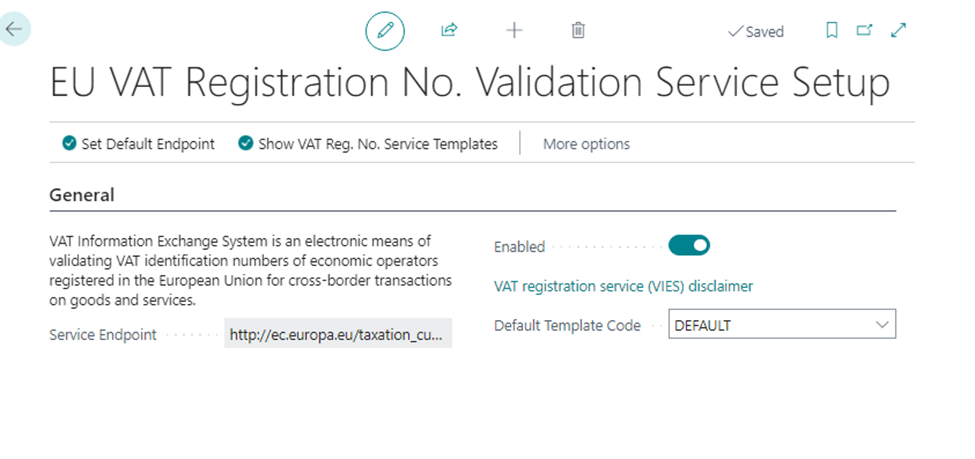

First of all make sure the standard option for the VAT validation service for EU is turned on: enter the page EU VAT Registration No. Validation Service Setup to enable the service.

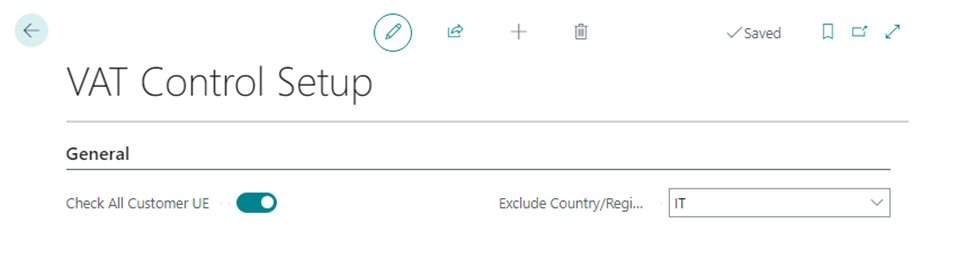

Enter the VAT control setup page and click on the "Check all EU customers" button to use AL VAT control functions. You can also exclude one specific country from the validity check, if needed.

HOW TO USE AL VAT CONTROL

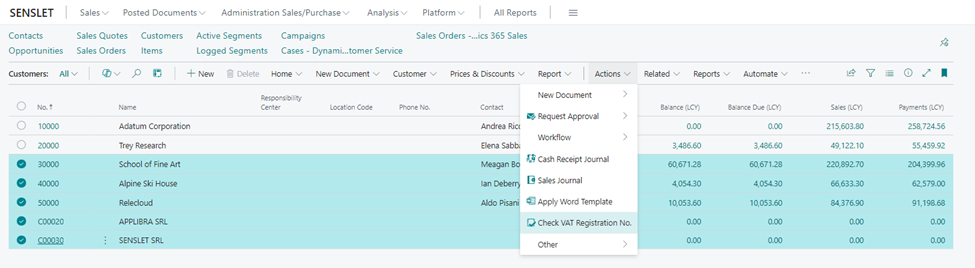

Search the customers list and select for which customers you need to check the VAT number, click on Actions and then on Check VAT Registration No. to control your customers' VAT numbers validity through the VIES system.

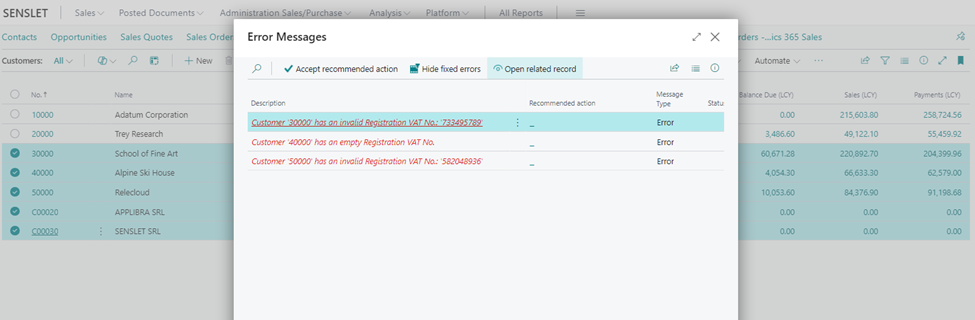

You will get a report of the customers in the EU whose VAT information are incomplete or missing, making it easier to identify errors and saving your time.

AL VAT Control proves to be useful also during orders releases and registrations: once the app setup is complete, when releasing an order for a customer whose VAT number is incomplete or missing, the system sends a warning message that notifies it. Whereas when registering an order for a customer whose VAT number is incomplete or missing, the system directly stops the order, preventing from potential issues.

In the event of warehouse shipments, the system stops the order also with the release command.

HOW TO SEPARATE THE ADDRESS INFORMATION WITHIN ITS SPECIFIC FIELDS

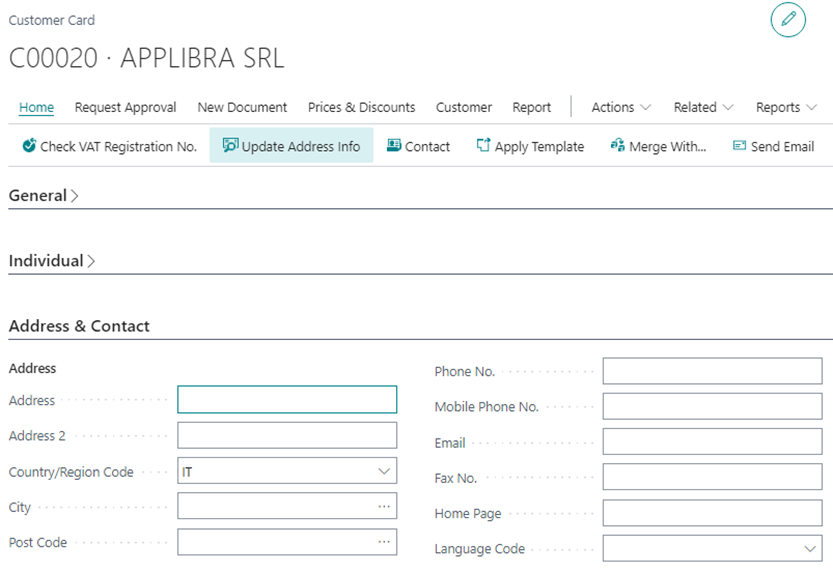

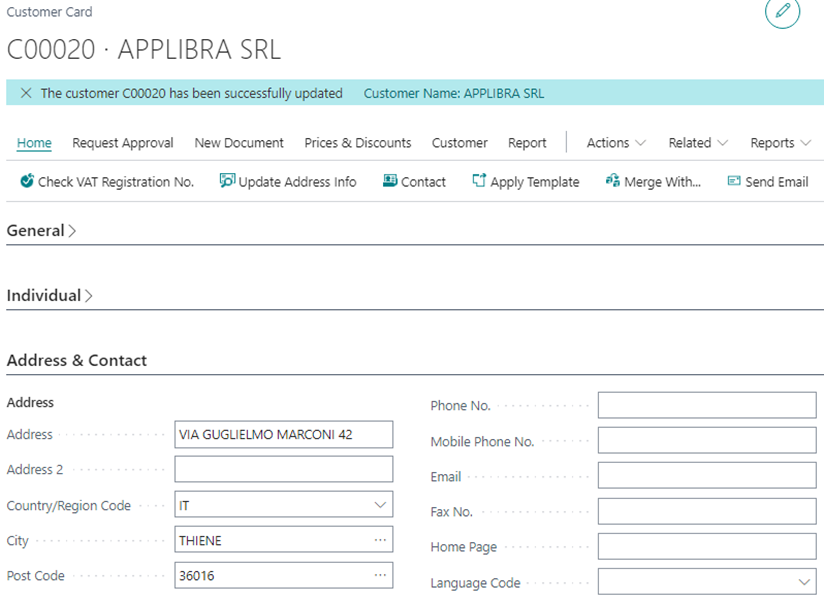

Enter the customer's card and click on Update Address information, AL VAT Control will retrieve the information of that company from the VIES system and fill it in its specific fields.