Help section for AL Free Gift

HOW TO CREATE ITEM CHARGES FOR FREE GIFTS

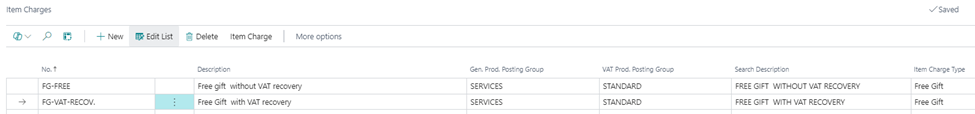

Once the app download is completed, enter the Item Charges page. Click on New and add the no., the description, the General product Posting group, select the VAT product posting group according to your need.

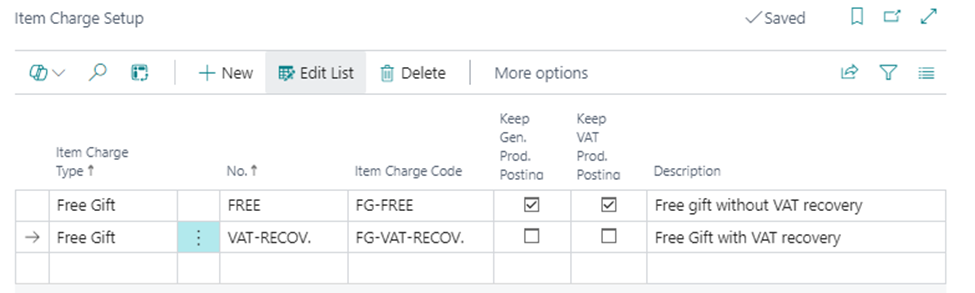

Enter the page Free gift charge setup enter the no., the description and flag the keep vat product posting group box, if you want your free gift to be without VAT recovery. Flag the box Keep general product posting group if you want to keep the item category.

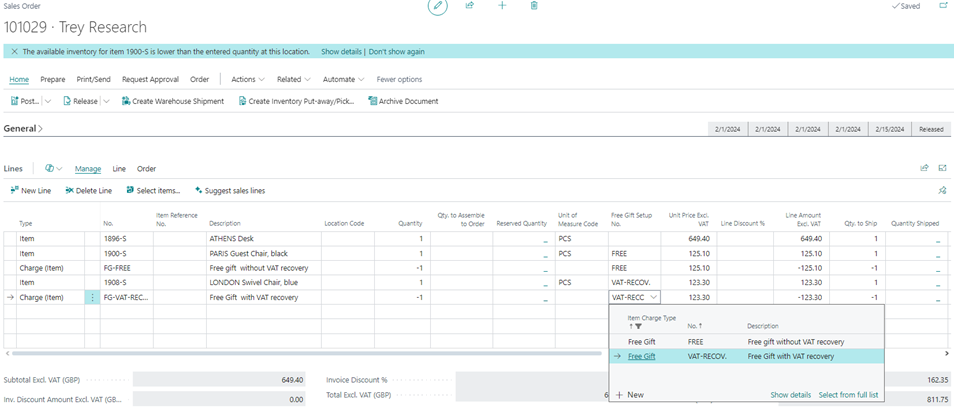

You can also modify the item charge type, the setup number and the item charge code of free gifts from the sales order lines, opening the Free Gifts Setup No. list. and clicking on New.

Select the Free Gift Setup No. for every item of your order that you want to give away for free. Make sure the Setup fits your needs as regards VAT recovery:

with VAT recovery; the customer gets the free gift, but is responsible for its VAT payment

without VAT recovery; the customer gets the free gift and the seller is responsible for its VAT payment

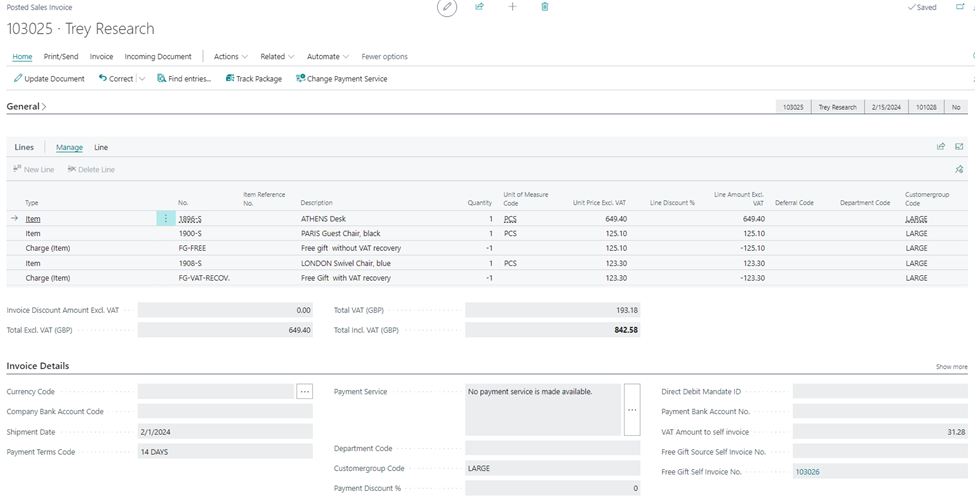

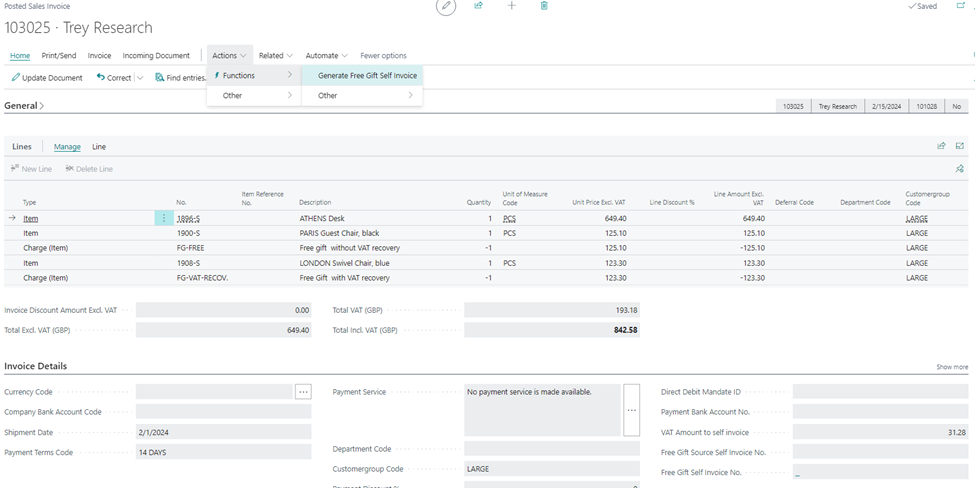

In this case the first item (Athens Desk) is sold regularly, while the other two are set as free gifts. In particular, the Paris Guest Chair is given away completely for free, because the VAT amount is the vendor's responsibility (€ 31.28); the London Swivel Chair is given away for free, but the VAT amount is the customer's responsibility, therefore the total amount of € 842.58 also includes the VAT payment for this item.

HOW TO ISSUE A SELF-INVOICE FOR ITEMS WITHOUT VAT RECOVERY

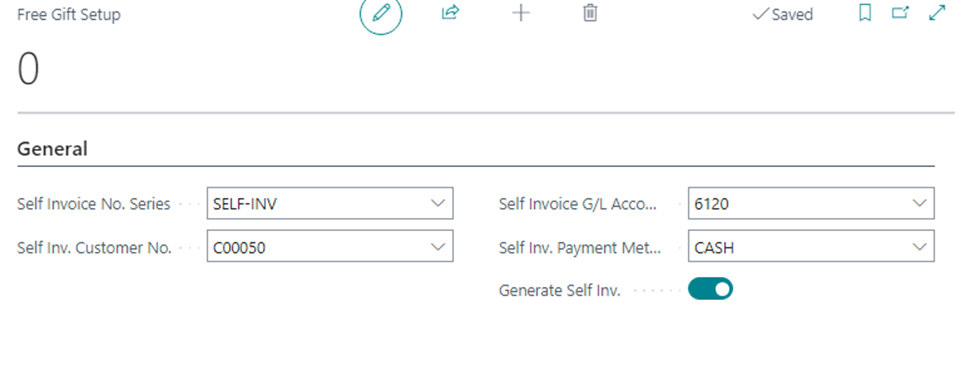

Enter the Free Gift Setup page, select the Self invoice no. series, for self-invoices the self invoice Customer No. needs to represent your company, choose the self-invoice G/L account and the self-invoice payment method. Activate the Generate Self-invoice, if you want to automatically issue self-invoices when giving away free gifts without VAT recovery.

This way when you post the invoice for your sales order, the system will also create a self-invoice.

If the button is not active, you can still issue self-billing invoices entering a posted invoice and clicking on the Generate Free Gift Self-invoice button.

The document shows three additional fields:

the VAT amount to self-invoice, showing the VAT amount of the items without VAT recovery

the Free gift source self-invoice no., that will show the invoice number (eg. 103025) on the self-billing invoice

the Free gift self-invoice no., that will show the associated self-billing invoice number once the self-invoice is posted